- Ganzhou Hengyuan Technology Co., Ltd. (Hengyuan Technology) is a rare earth resource comprehensive utilization company which engages in recycling waste rare earth permanent magnet. The main businesses of our company are as follows: a. Rare earth oxide, including PrNd oxide, gadolinium oxide, dysprosium oxide, terbium oxide, holmium oxide, cerium oxide, etc; b. Rare earth alloy, including PrNd mischmetal, ferrogadolinium, ferrodysprosium, ferroholmium, etc.

- Asian Metal: Hello, Mr. Ye! Thank you for accepting this interview of Asian Metal. Could you please introduce your company and your main business briefly?

- Mr. Ye: Ganzhou Hengyuan Technology Co., Ltd. (Hengyuan Technology) is a rare earth resource comprehensive utilization company which engages in recycling waste rare earth permanent magnet. The main businesses of our company are as follows: a. Rare earth oxide, including PrNd oxide, gadolinium oxide, dysprosium oxide, terbium oxide, holmium oxide, cerium oxide, etc; b. Rare earth alloy, including PrNd mischmetal, ferrogadolinium, ferrodysprosium, ferroholmium, etc.

Frontdoor of Hengyuan Technology

Office building of Hengyuan Technology

- Asian Metal: Thank you for your introduction. Would you please give us a brief introduction of your career?

- Mr. Ye: After I worked in Ganjia Rare Earth Co., Ltd. in 1989, I have been engaged in the rare earth industry for about 30 years. I set up Ganzhou Hengyuan Technology Co., Ltd. and Ganzhou Future Electronic Co., Ltd. with different shareholders respectively, and the two companies have both listed on the New Three Board. Now I mainly work in Hengyuan Technology.

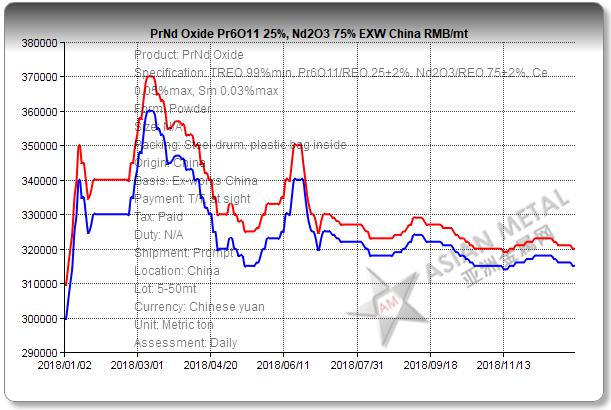

- Asian Metal: Looking back to 2018, just as the Asian Metal's graph of Chinese PrNd oxide price trend, Chinese PrNd oxide price showed a downtrend after the Spring Festival in 2018, and then the prices hovered at RMB315,000-330,000/t (USD45,785-47,965/t) in H2, 2018. What do you think about the price fluctuation in 2018? Can you share us your opinion of the price prediction in 2019?

- Mr. Ye: There are three main reasons that accounted for the price trend in 2018: For one thing, the main reason for the sliding prices in H1, 2018 was that the Chinese PrNd oxide price soared up in the first three quarters but declined sharply in Q4 2017. For another thing, Chinese PrNd oxide price rebounded in June 2018 but failed to increase continuously as the trade war among US and China broke out. Furthermore, the stalemate of trader war resulted in the negative growth for NdFeB magnet, especially for low performance NdFeB magnet, so the softening demand from downstream customers was also one of main reasons for the price trend.

- As for the market in 2019, I forecast that the PrNd oxide price in 2019 would stand firm as a whole, and I estimate the market in H2 2019 would be better than H1 2019.

Chinese PrNd oxide Pr6O11 25% Nd203 75% price trend in 2018

- Asian Metal: Standing at the boundary of 2018 and 2019, most market insiders hold optimistic attitudes towards dysprosium, terbium and other heavy rare earth markets, and what's your opinion? Taking dysprosium oxide for an example, what do you think about the price trend in 2019? Are there some key factors that would boost the price reviving in the coming year?

- Mr. Ye: With the development of new technology, Chinese magnet end users' demand for high performance NdFeB magnet increases, and thus the demand for dysprosium and other heavy rare earth products increases as well. For example, encouraged by the technology for permeating dysprosium into high performance NdFeB magnet, the dysprosium oxide consumption increases continuously. What's more, market participants are worried about the regulation on importing ionic rare earth concentrate, which would tighten the supply in 2019. Forecasting the dysprosium oxide market in 2019, I believe the price would show a rising trend as a whole, while the increase would depend on the market supply.

Rare earth oxide products of Hengyuan Technology

(a) dysprosium oxide (b)praseodymium oxide (c)PrNd oxide

- Asian Metal: As your company is a rare earth resource comprehensive recycling utilization company, can you introduce us the status of rare earth waste recycling industry?

- Mr. Ye: I believe that each industry would go through a process that it develops from shortage of capacity to the oversupply, and then it returns to be balanced. Now the rare earth recycling industry undergoes the process, so what the enterprises need to do is to promote the competitiveness and technology innovation to adapt to the market. As for the problem on the oversupply or the market balance, just let the market adjust.

- Asian Metal: In recent years, Chinese rare earth recycling plants face the tight supply of waste magnet due to the overcapacity, so enterprises usually competitively purchase the material with higher prices. What do you think about this phenomenon? As for some recycling products, magnet suppliers could not provide the rare earth special invoice, and what's your opinion? Is there some experience in Ganzhou district?

- Mr. Ye: Personally, I believe it is a problem related with the survival of rare earth recycling enterprises, which caused by the unbalanced supply and demand. Through the purification of the market, this phenomenon would disappear entirely. As for the rare earth tax and invoice, it is regulated by the government, and our enterprises can do nothing but to obey rules. However, I should point out that all the products from rare earth recycling plants are sold with rare earth special invoice eventually whatever whether the raw materials suppliers provide the rare earth special invoice or not.

Workshop of Hengyuan Technology

(1) pretreatment process (2) extraction process (3) precipitation process (4) calcination process

- Asian Metal: In 2018, China Southern Rare Earth merged the rare earth comprehensive recycling utilization enterprises by holding shares. I know your company is one of cooperated enterprises, so what's the most advantage for this model?

- Mr. Ye: I must point out that it is not the group that governs the rare earth recycling plants, but it is a surviving strategy for recycling companies located in Ganzhou and also an inevitable result for the market development optimization process. This model has made enterprises avoid competing fiercely and has provided the sufficient cash flow for those companies, so that these companies can survive in the market. Therefore, I take the place to thank China Southern Rare Earth Group to offer the platform for recycling plants gathering together.

- Asian Metal: As you know, the imported rare earth ore increased sharply in 2018, and what do you think of the imported rare earth concentrate? From the aspect of production cost, do you believe the recycling companies are still competitive to face the challenge?

- Mr. Ye: The increasing imported rare earth concentrate would affect the supply in domestic market, so it would have an effect on the market price eventually, while the influence on rare earth recycling industry would be temporary. Considering the producers' production costs, as the raw material prices range from the market trend, the profits for waste recycling plants are relatively stable. Once enterprises control product quality and production costs well, it is not a problem for these companies to be competitive.

- Asian Metal: According to the public information, your company began to build phase II rare earth metal and alloy project with an annual production capacity of 3,000t in August 2017, and what's your original intention for this movement? What's the advantage for recycling plants expanding metal and alloy businesses?

- Mr. Ye: Rare Earth metals and alloys are raw materials for NdFeB magnet production, and they are also important parts for the rare earth utilization and development. Expanding metal and alloy businesses would ensure us to extend the industry chain and purchase magnet waste by exchanging metal products directly, so that we would be more competitive among recycling plants. Besides, seen from the development of Chenguang Rare Earth and Qiandong Rare Earth Group, we find it is a key step for our company to develop bigger and stronger.

Manufacturing plant of Hengyuan Technology

- Asian Metal: How about your business in 2018? Do you have some new plans and visions for 2019?

- Mr. Ye: Our plant operated regularly in 2018, with sales increasing by about 35% YOY while profits declining by approximately 74% YOY. About the plan for 2019, we will promote competitive and innovation abilities to promote sales and products' quality. I predict the sale in 2019 would continue rising by over 30% YOY and the profits would increased by 6 times compared to this year. I firmly believe that our company would face new development opportunities in the coming year through the joint effort and hard work of my team.

- Asian Metal: I learnt that your company was listed on the New Three Board in August, 2016 ("Hengyuan Technology", stock code: 838952). What changes have your company experienced before and after the New Three Board listing? After linking with the capital market, what is the change for operation and management?

- Mr. Ye: We have some changes after listing the New Three Board: Firstly, we develop in compliance; secondly, we increase financing channels; thirdly, we develop technology innovation, including talent introduction. After docking with capital market, we found the development direction and confidence.

- Asian Metal: Can Mr. Ye share us the feelings about the company management and administration?

- Mr. Ye: The core competence and the pursuit of innovation are key factors to develop well. I feel that paying more attention to details determines the success and failure of the enterprise management and administration.

- Asian Metal: Asian Metal is the "Third platform" for market information, and also provides the reference prices for your company. Can Mr. Ye give us some suggestions about our service?

- Mr. Ye: Asian Metal provides the comprehensive, high quality and actual market information, and has been widely recognized by rare earth enterprises. I expect Asian Metal to insist on providing the accurate, timely and comprehensive market information and data, acting as the adviser to enterprises.

- Asian Metal: Thanks, Mr. Ye! Asian Metal will carry your vision to provide the objective, professional and authoritative market information for the industry. Thanks again for your sharing and support! Wish you every success in your business!

- Mr. Ye: Thanks for giving me such an opportunity to communicate on the market and present my company. I wish Asian Metal to become the authoritative website in China, Asia and the world!