Manganese flake price to soften in Q4

----Interview with Wang Xiaodong

Sales General Manager

Harbin Dongsheng Metal Co., Ltd.

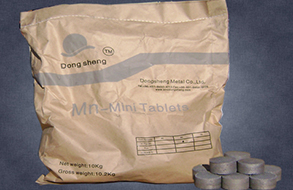

- Founded in 1995, Harbin Dongsheng Metal Co., Ltd. is a joint stock high-tech enterprise integrating scientific research, production and sales of additives (such as manganese, iron, copper, titanium, chromium, nickel additives and fast-melting silicon), intermediate alloys (such as aluminum zirconium alloy, aluminum vanadium alloy, aluminum copper alloy, ferroaluminum, aluminum titanium alloy), flux, titanium boron refiner and so on.

- Asian Metal: Mr. Wang, thank you very much for accepting our interview. Please give us an overview of your company and business.

- Mr. Wang: Founded in 1995, Harbin Dongsheng Metal Co., Ltd. is a "single champion demonstration enterprise of manufacturing industry" affirmed by Ministry of Industry and Information Technology and a "national intellectual property right demonstration enterprise" and a "national intellectual property right strategy implementation advanced enterprise" affirmed by National Intellectual Property Administration. We have obtained more than 40 patents at present, two of which won the 17th and 19th "National Patent Prize" respectively, and own proprietary intellectual property rights of flux metal additives, aluminum metal additives and fast-melting silicon, including more than 30 aluminum alloy accessories. With three production bases in Heilongjiang and Hebei, we keep long-term stable partnership with more than 300 customers worldwide and sell our products to 51 countries and areas. Harbin Dongsheng Metal is the global strategic partner of Rusal, Arconic, Norsk Hydro, Novelis, Rio Tinto and other five world's top 10 aluminum companies and top 10 Chinese aluminum companies.

- We have been focusing on research, production and sales of additives for years and can arrange customized production based on customers' requirements on specification. We have an annual production capacity of 30,000 tons of manganese additives now and get a large market share in the global manganese additive consumption market.

- Asian Metal: Harbin Dongsheng Metal is one of famous manganese additive producers in the world. Please give us an introduction of the types, raw material and applications of your manganese additive products.

- Mr. Wang: There are cosolvent manganese additive and pure aluminum environmental-friendly manganese additive now and major contents of manganese stand at 75%, 80% and 85%. Most Chinese customers use cosolvent manganese additive with manganese content of 75% while customers in North America and Europe have higher requirements and select pure aluminum environmental-friendly manganese additive with manganese content of 80% or 85%. The main raw material of manganese additive is manganese flake. In terms of application, manganese additive is mainly used for production of 3000 series aluminum alloy, which is the raw material of beverage can and building decoration industry, such as aluminum curtain wall and decorative sheet.

- Asian Metal: What are your opinions about current global supply and demand of manganese additives and the future development trend of application?

- Mr. Wang: From the perspective of supply, China is a major manganese flake producer and manganese flake is one of the main raw materials of manganese additives, so most manganese additive producers are located in China. According to our estimate, the annual global demand for manganese additives is about 90,000 tons. The demand for manganese additives would grow continuously and steadily in future amid rising global aluminum consumption.

- Asian Metal: What are your product and operation advantages compared with other Chinese and overseas manganese additive producers?

- Mr. Wang: After making efforts for years in manganese additive industry, our company has been highly recognized by downstream customers worldwide in brand influence, industry reputation, product quality and management operation. Especially in terms of industry reputation, we execute orders strictly based on contracts that are signed with customers no matter whether upstream raw material prices soar or slump. In terms of product quality, we have excellent research and production capacity and are able to arrange production according to customers' requirements on specification and guarantee the stability of product quality, which is an important aspect of our core competitiveness.

- Asian Metal:?Could you tell us something about the exports and domestic trade volume of your manganese additives in 2019? And what are the changes compared with the same period of last year?

- Mr. Wang: In spite of weak downstream demand from overseas customers in Q3 and Q4, our export volume of manganese additives in the first nine months of 2019 still rose by 19% YOY. However, we suffered a decline in trade volume in Chinese market. On the one hand, the China-U.S. trade friction resulted in additional tariffs on our downstream steel and aluminum products; on the other hand, the overall export volume of steel and aluminum decreased this year due to declining downstream demand from overseas market, so our trade volume in domestic market was impacted.

- Asian Metal: Harbin Dongsheng Metal is one of major Chinese manganese flake consumers. May I know your purchase volume and consumption volume of manganese flake in 2019?

- Mr. Wang: We purchase manganese flake based on steady long-term agreements with major Chinese producers now, so we can continuously ensure stable production of manganese additives. We consume around 2,000 tons of manganese flake on a monthly basis.

- Asian Metal:?Manganese flake is the main raw material of manganese additives. Prices for manganese flake basically stood at RMB13,000-13,500/t (USD1,837-1,908/t) EXW D/P in Jan-Jul 2019 and began to decline sharply from August. What were the main reasons in your opinion? What do you think about the manganese flake price trend in Q4?

- Mr. Wang: Manganese flake prices showed a flat trend in H1 2019 because supply and demand were relatively balanced and major Chinese producers controlled prices intentionally. I attributed the sharp decline from August to the sharp increase in operating rate of Chinese manganese flake producers from May. The sluggish steel and aluminum industries both in China and at overseas starting from Q3 led to decreasing demand for manganese flake while Chinese manganese flake producers still ran at a high operating rate, resulting in increasing inventory pressure. Finally, due to fierce competition among some Chinese producers, manganese flake prices moved down notably in Chinese market in August.

- Current manganese flake price is close to the production cost of some Chinese manganese flake producers and some small producers suffer losses. Considering continuously weak downstream demand, I'm of the opinion that manganese flake prices would edge down in Q4.

- Asian Metal: What will be your development opportunities and challenges in future?

- Mr. Wang: From the macro perspective, China's economy will continue to grow steadily. Presently, the per capita aluminum consumption in Europe, America and Japan is far beyond that in China, so China has great potential to increase aluminum consumption. We will continue focusing on additives, increase research investment and further improve product quality to win future industry benefits. We are confident about our future.

- Asian Metal: Thanks again for accepting our interview. Best wishes to you and wish Harbin Dongsheng Metal a booming business.

- Mr. Wang: Thank you and wish Asian Metal a brighter future.