Aiming at supplying high-performance material to new energy industry

----Interview with Tao Wu

Board Director of CNGR Group and General Manager of Operation Center

CNGR Co., Ltd.

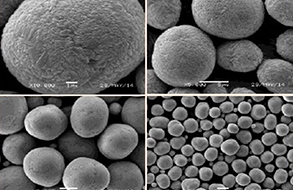

- As a subsidiary of CNGR Group (hereinafter referred to as CNGR), CNGR Co., Ltd. is a national high-tech company and is listed as a key-supported company by NDRC and Ministry of Science and Technology. It has been approved to use industry upgrading special funds allocated by MIIT in accordance with China Manufacturing 2025 to construct a green manufacturing system integration project and a smart manufacturing new mode application project. Meanwhile, it has won the title of National Green Plant awarded by MIIT and other honorary titles such as the Technology Innovation Enterprise in Guizhou, Innovation-Driven Leading Enterprise, Technology Center for Provincial Enterprises and Demonstration Base for Production and Research. Mainly engaging in R&D, production and sales of NCM precursor, cobalt tetroxide and other lithium battery cathode material precursor, CNGR Co., Ltd. owns a production base in West China and Central China respectively and is expanding production stably now.

- Asian Metal: Hello, Mr. Tao! Thank you very much for accepting the interview of Asian Metal. Firstly, would you please give us a brief introduction to the business of you company?

- Tao: CNGR started to do new energy business from 2013 and CNRG Co., Ltd. became one of top three producers for NCM precursor and cobalt tetroxide in China in 2018. CNGR's production capacity of NCM precursor reaches 90,000tpy in the second half of 2019, while that of cobalt tetroxide reaches 15,000tpy. With precursor business as its leading business, CNGR aims to supply high-performance material to new energy industry and is making efforts to realize greater targets now.

- CNGR's precursor sales reached 30,000t in 2018, ranking second within the industry for two consecutive years, while its sales for cobalt tetroxide exceeded 6,000t. In addition, CNGR's total sales target for precursor and cobalt tetroxide is 60,000-70,000t in 2019.

- Asian Metal: What's your plan in both the domestic and overseas markets in 2019 as a NCM precursor producer, whose production capacity and output are among the top levels in China? And what do you think of the new energy market in Europe?

- Tao: CNGR Co., Ltd. has been closely following the pace in the international market since it was established. For example, we have been exporting our products to South Korea in large volumes and have accelerated to improve our influence in Japan, America, Europe and other countries and regions. According to related data, the precursor exports of CNGR Co., Ltd. have been among the top three for two consecutive years. Our NCM precursor exports broke 10,000t for the first time in 2018 and ranked first among China in the first half of 2019. The two achievements couldn't be made if we hadn't seized the opportunity that South Korea sought development in global new energy market in 2016 and 2017.

- We think that Europe would be the most prospective market worldwide in the coming three years. Europe vehicle industry is a relatively large market for precursor. European vehicle companies, which have finished initial R&D for new energy vehicles, are purchasing raw material and introducing technology now. We are optimistic towards the demand for precursor in Europe in the coming three years and expect that the increase speed of the demand there would be rapider than that in USA and China.

- Asian Metal: It's known that downstream consumers have adjusted their demand for different specifications of NCM precursor due to decreased subsidies on new energy vehicles. What does your company do to respond to the changed demand in the market?

- Tao: In terms of technology, CNGR owns advanced technology to produce different specifications of NCM precursor, including 5 series, 6 series and 8 series of NCM precursor. Thus, we can design, produce and supply different specifications of NCM precursor based on specific requirements from our customers. Meanwhile, market plays a more and more important role in the development of new energy industry while the role of government, which is said to play a key role in leading the development of new energy industry, is weakening gradually as the domestic new energy market is on the spiral rise now in spite of decreased subsidies on new energy vehicles. As for this, what CNGR does is to cooperate with end users, namely major reliable vehicle producers, as soon as possible and thus the policy related to decreased subsidies doesn't bring heavy influence on CNGR.

- We think that the spiral rise on Chinese new energy market caused by decreased subsidies would bring a short-term development opportunity to our company. In fact, both the changing products and changing market are good development opportunities for all companies which have finished technology and product reserve. We want to take this opportunity to raise our sales and improve our customer structure before the end of 2019.

- Asian Metal: Many downstream consumers are boosting R&D on high-nickel NCM precursor now, leading to more demand for the material. Would you like to share with us the advantages and features of your company in this field?

- Tao: High-nickel NCM precursor represents a development trend due to lower production costs and longer service life for batteries produced by the material. Furthermore, high-nickel NCM precursor market develops more rapidly than expected. People used to think that the development of high-nickel NCM precursor might be delayed for safety problems, but now we can see that high-nickel NCM precursor will be widely used in battery systems in 2021 at the latest given the demand for the material in the current market.

- Owning a professional technology team, CNGR can optimize the demand from our customers and provide high-performance and high-quality NCM precursor to customers in accordance with their specific requirements.

- Asian Metal:?We know that high-nickel NCM precursor, such as precursor 811, hasn't been widely used in vehicles due to safety problems and is just used in some 3C products. What's your opinion about this?

- Tao: The development of high-nickel NCM precursor is mainly restricted by safety problems, battery testing problems and cost issues. However, as we all know that nothing can be developed without the process of gradual exploration and improvement. Furthermore, with more and more companies starting R&D for high-nickel NCM precursor, people will accumulate more experience and data on the material and accordingly the development of the material will come into a mature period. Related companies should constantly improve the performance of the material and control the production costs through testing in the current immature development period.

- In view of the current technology and investment plan, we think that 8 series of NCM precursor can be widely used in vehicles in the second half of 2020 at the earliest and 2022 at the latest.

- Asian Metal: Although many different raw materials can be used to produce nickel salts now, the financial values of battery grade nickel liquid produced by nickel briquette (or nickel powder) solution and battery grade nickel sulfate crystal are different calculated by current nickel cathode prices. How do you respond to this phenomenon?

- Tao: In view of higher production costs to produce battery grade nickel sulfate crystal, many battery grade nickel sulfate producers choose to use nickel briquette (or nickel power) solution as raw material to produce battery grade nickel sulfate liquid. CNGR has an annual production capacity of 12,000 metal tons of nickel sulfate now and will expand the annual production capacity to 30,000 metal tons in the second half of 2019.

- It's helpful for us to control production cost when we use nickel briquette (or nickel powder) solution as raw material to produce nickel sulfate liquid in the long run. Prices for nickel briquette (or nickel powder) are a key factor to reflect financial values of battery grade nickel sulfate liquid in both now and the future. Meanwhile, nickel briquette (or nickel powder) solution can make battery grade nickel sulfate liquid have higher financial values because this kind of raw material must be used together with other raw materials rather than be used independently.

- It seems that the financial value of battery grade nickel liquid using nickel briquette (or nickel powder) solution as raw material is limited now, but the application of this raw material will be a trend in the long run. We will use nickel briquette (or nickel powder) solution as raw material to produce battery grade nickel sulfate in the future unless prices of other raw materials are lower. That is to say, nickel briquette (or nickel powder) will be our best choice to produce battery grade nickel sulfate in the future.

- Asian Metal:?What do you think of the market outlook for NCM precursor and cathode material in the fourth quarter?

- Tao: We think that prices for NCM precursor and cathode material would generally show an upward trend during 2019. Now we expect that electric vehicle output would increase by about 30% throughout 2019, while the figure we expected in early 2019 was as high as 50%. In addition, the proportions of electric vehicle outputs of BYD and CATL among the total vehicle output in China will rise.

- We are optimistic about NCM precursor market in 2019 and expect that the decreased subsidies on new energy vehicles would only limit our sales for two months. In addition, we will seize the opportunities in both the overseas market and the domestic 3C market to make our NCM precursor sales reach more than 70,000t in 2019.

- Asian Metal: Thank you again and wish your company a bright future!