Striving for localization of ITO target

----Interview with Huang Shicheng

Executive Vice President

Guangxi Crystal Union Photoelectric Materials Co., Ltd.

- Established in September 2007 with a registered capital of about RMB85 million (USD1.27 million), Guangxi Crystal Union Photoelectric Materials Co., Ltd. (CUPM) is a high-tech enterprise specializing in R&D, production and sales of ITO target under Longhua Science and Technology Co., Ltd.

After passing the test of Truly Semiconductors for 2.5-generation production line and that of BOE for 6-generation production line and 8.5-generation production line, CUPM was accepted by major Chinese TFT-LCD producers and became one of pioneer TFT target suppliers. The company has established long-term cooperation with customers from TP, TN, STN-LCD and other fields.

- Asian Metal: Thank you for accepting our interview. Firstly, please give us a brief introduction of your business.

- Mr. Huang: CUPM has been specializing in R&D, production and sales of ITO target after its establishment, comprehensively promoting localization of ITO target.

- Asian Metal: Please tell us something about yourself.

- Mr. Huang: I graduated in 2009 and started my first job in CUPM as a R&D staff in the same year. I joined the company as a green hand and have gained experience in production and quality control of ITO target in the past decade.

- Asian Metal: CUPM has been engaging in ITO target business, so what's your strategy?

- Mr. Huang: For further developing the market, CUPM set up a wholly-owned subsidiary in Luoyang of Henan in 2017, namely Luoyang Crystal Union Photoelectric Materials Co., Ltd. With an annual production capacity of 60t of ITO target, CUPM's Liuzhou facility can no longer meet customers' demand. Therefore, Longhua Science and Technology began to construct a new ITO target production line with the annual production capacity of 200t in Luoyang and expects to finish the construction in two years. Currently, the first phase of project with an annual production capacity of 60t has been put into operation.

- We are committed to production of TFT target, the most popular product in ITO target market.

- Asian Metal: What are your advantageous products?

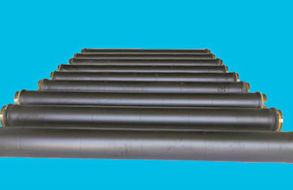

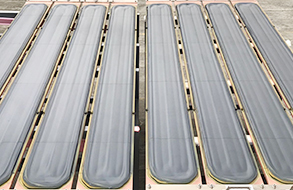

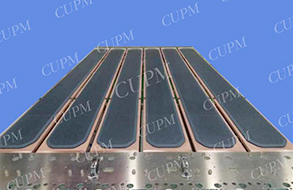

- Mr. Huang: We have plate target and rotary target now.

- Our plate target products have obtained certain market shares in China. Meanwhile, CUPM is the largest supplier of TFT target supplier in mainland China.

- We have got approvals for 15 TFT target production lines so far, which enable us to be a qualified supplier.

- Asian Metal: Localization of ITO target is always a hot topic. Could you please talk about the ITO target industry in the past three years as well as the industry outlook in the next three years?

- Mr. Huang: Firstly, I want to talk about the development history of Chinese ITO target industry. Three years ago, a large number of ITO target producers began to apply for TFT certification, but most of them failed and left ITO target market successively. Thus, they turned to TP field and other medium and low-end fields. CUPM got TFT certification and began mass production.

- Chinese producers are able to produce most TP products, so they are working on TFT target now. In the coming three years, most producers will focus on production of TFT target products. Currently, CUPM also tries its best to develop TFT target market.

- Asian Metal: What are your opinions in recent development of LCD panel, the end user of ITO target? And what impacts will it bring to ITO target industry?

- Mr. Huang: With increasing demand for LCD panel in mainland China, high-generation TFT-LCD production lines consume more ITO target. It's predicted that high-generation TFT-LCD production lines will run at full capacity in the next three years, which may result in oversupply of LCD. However, the market outlook is still optimistic as demand from Japan and Taiwan would increase.

- Asian Metal: ITO target industry is a major consumer of indium and it consumes over 70% of the material. Indium prices hovered at RMB1,300-1,600/kg (USD194-238/kg) in the recent two years. What will the indium price trend look like? As an indium consumer, what are your expectations for upstream suppliers?

- Mr. Huang: In terms of supply and demand, indium prices wouldn't fluctuate violently, but prices are likely to be affected by indium inventories of Fanya Metal Exchange, for which insiders are pessimistic about market outlook. In my view, we should take the abovementioned indium inventories into consideration when we talk about indium market outlook.

- From the perspective of an indium consumer, production cost of ITO target will rise by at least 20% if indium ingot prices increase by 30-40%, because there are just a few Chinese ITO target producers and indium is a key raw material of ITO target.

- Asian Metal: Could you share your future plan with us?

- Mr. Huang: We will try to capture one third of TFT market shares in China in three years and realize localization indeed.

- Asian Metal: Thanks again for your comments. Wish you a thriving business!