Copper fundamentals to support higher price in 2018

----Interview with Wang Xing

Head of Marketing Division

Shaoxing Pingtong (Group) Co., Ltd.

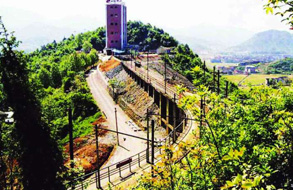

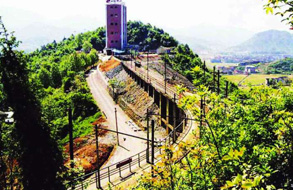

- Shaoxing Pingtong (Group) Co., Ltd. ("Pingtong Group" for short), formerly known as Pingshui Copper Mine founded in 1967, is the largest nonferrous metal raw material production base in China's Zhejiang province. Pingtong Group owns several subsidiaries including Shaoxing Tongdu Mining Co., Ltd., Shaoxing Yueyu Copper Strip Co., Ltd. and Zhejiang Zhongxia New Building Materials Co., Ltd., etc. and has formed the integrated economic entity that specializes in mining and dressing, copper processing, production of building material as well as trading.

- Asian Metal: Thank you very much for accepting the interview with Asian Metal. Would you please first give us an introduction to the main business and production status quo of Pingtong Group?

- Mr. Wang: Pingtong Group, formerly known as Pingshui Copper Mine founded in 1967, renamed Shaoxing Pingtong (Group) Co., Ltd. in July 2003. With a registered capital of RMB130 million, it is a wholly state-owned and medium-sized mining enterprise affiliated to Shaoxing Industrial and Trade State Asset Co., Ltd. After 50 years of operation, Pingtong Group has developed as a diversified business entity that specializes in mineral mining and dressing, copper processing and production of new types of building material, and owns 1 wholly-owned subsidiary (Shaoxing Yueyu Copper Strip Co., Ltd.), 1 holding subsidiary (Shaoxing Tongdu Mining Co., Ltd.) and 1 joint stock company (Zhejiang Zhongxia New Building Materials Co., Ltd.). Being the largest nonferrous metal raw material production base in Zhejiang province, Pingtong Group has an annual raw ore processing capacity of 240,000t and can produce 1,700t of copper metal, 2,500t of zinc metal, 60,000t of standard sulfur, 10,000t of brass copper strip of various specification, 200,000 cubic meters of sand and gas cutting block, 80 million limesand bricks annually.

- Asian Metal: As the world's largest copper-consuming country, China has a strong demand for copper concentrate, but the self-sufficiency rate of domestic copper concentrate is not high. As a Chinese copper concentrate producing company, what do you think are the main problems faced by domestic copper ore enterprises? Are there any good ways to improve such situations?

- Mr. Wang: Chinese copper ore enterprises are facing several problems including low grade of raw ore, outdated technology, heavy burden on old stated-own enterprises, decreased safety investment caused by heavy tax burden and low economic benefit, insufficient support from government to mine as well as the difficulty in applying for bank credit. In term of safety and management risk control, mining company can strengthen production safety and avoid the risk of fluctuating market prices by obtaining support from government. For example, government can increase funding for safety investment and reinforce approval for hedging.

- Asian Metal: Copper price went up sharply by 31% in 2017. What do you think are the factors that led to the steady rise of copper price last year?

- Mr. Wang: I believe that factors like workers' strike, environment protection, import policy changes, de-capacity task, the oversupply being eased, and the strong negative correlation between US dollar index and copper price have all played a critical role in driving up copper price in 2017.

- Asian Metal: The negotiation time period for the long-term TC for copper concentrate of 2018 is relatively long and the dispute of opinion between miners and smelters mainly lies in the relationship of supply and demand in 2018. The long-term TC for copper concentrate this year was finalized at USD82.25/t which declined quite a bit compared with USD92.5/t in 2017 and also recorded the lowest level in recent 5 years. Does this mean that the market would still witness a tight supply of copper concentrate in 2018? What's your opinion on the supply-demand relationship in copper market this year?

- Mr. Wang: In early 2018, domestic smelting giants adjusted price coefficient successively which hasn't reached historical high but still indicates smelting enterprises' optimistic attitude toward the copper market in 2018. The global market witnessed a negative growth in copper supply last year affected by incidents like workers' strike, while the global copper output is expected to increase by about 3% on a low base in 2018. In the context of sharply decreased capital expenditure in global copper market, the new capacity of copper ore is expected to be rather limited in the future. With the copper ore supply to peak in 2019-2020, TC for copper concentrate had already peaked and is likely to experience a downtrend after being on the rise for years. In addition, the facts of the gradually declining grade of copper ore and the faster depletion of resource at global large-sized and high-quality copper mines, along with no major exploration discovery, rapid development of consumers' market in China and India as well as the demand of electrified energy and transportation electrification and so on all led to the steady copper consumption globally which is likely to rebound slightly in the future. Generally speaking, copper fundamentals would help to support higher copper price in 2018.

- Asian Metal: Copper price went up continuously in December 2017 both at home and abroad, however, the tight capital at year end and downstream customers being in slack season seemed not to support higher copper price. What do you think led to the continuous rising of copper price last December? What's your prediction on copper price trend in 2018?

- Mr. Wang: In 2017, copper price rebounded strongly with LME copper price increasing by over 30%, hitting a new record high in four years. The rebound in copper price is closely tied to changes of news about the market. Key factors including strike, environmental protection, import, Shaanxi cable incident and TC for copper concentrate all exerted positive influence on the continuously increasing copper price in December 2017 and might drive price up further in 2018. In light of the current market situation, most well-known companies and organizations including Codelco, Goldman Sachs and Citibank and so on expect copper price to remain stable at USD6,500-7,000/t in 2018 which is obviously higher than that in 2017. Therefore, the 2018 copper market has a more optimistic outlook. In addition, we need to focus more on policy changes at home and abroad as well as the copper production at international large-sized mines.

- Asian Metal: The US dollar index has declined sharply in succession since January 11 this year, but copper price doesn't seem to go up with decreasing US dollar index as usual. Does this reveal any new signals in the market? Are there any other noteworthy phenomena in the market that insiders and investors should pay attention to?

- Mr. Wang: Looking back into late 2017, the copper market closed with a prevailing expectation of price uptrend; besides, LME copper price had risen uncommonly for a 15th consecutive month. Entering 2018, copper price is expected to edge down after rising too fast previously. After the New Year's Day holiday, the market witnessed a slowdown in the increase of copper price which mainly fluctuated within RMB54,500-55,500/t (USD8,643-8,801/t) in Shanghai market and began to show horizontal price movement. Despite having certain upward momentums, Shanghai copper price remained confined to the current range. In addition, March and April are usually the peak season for traditional industries and most customers would choose to replenish stocks before the Spring Festival. Whether copper price will go up further or drop all the way down is the question that concerns market participants the most. Generally speaking, there has been no good news from a macroscopic view; the early signs of tight supply and weak demand of copper waste mainly contributed to the stagflation of copper price.

- Asian Metal: As a bulk commodity with financial attribute, copper is largely affected by factors of policy changes at home and abroad as well as economic growth and usually experiences relatively drastic fluctuations of price. Through what ways do you think can mining enterprises preserve or increase product value in the context of the drastic fluctuation in copper price? How to realize increased revenue from higher copper price and raise profit level at the same time?

- Mr. Wang: This is a very tough question. Enterprise nature is of critical importance. State-owned enterprises must be based on the principle of central government's "Three-Importances & One-Large" policy in order to join the hedging system and must not ignore the law and order for benefits. And for private companies, to join the hedging system is a must for avoiding risks but the hedging quota shall be adjusted according to the size of business. There is no reference standard.

- Asian Metal: How do you think domestic miners can increase the supply of copper concentrate in 2018 and at the same time make a contribution to the China's supply-side structural reform?

- Mr. Wang: State-owned mining enterprises' annual output is strictly in accordance with the digging schedule and perusing staged benefits by ignoring safety in production is unacceptable. As for supply-side structural reform, mining enterprises can increase capacity by purchasing raw ore and improve economic effectiveness in order to make a contribution. Of course, there are risks in the process but we can lock in some benefits through hedging.

- Asian Metal: Thank you for sharing your opinion on copper market with us and wish your company a prosperous future!