- Peak Resources is an Australian listed company (PEK) aiming to become one of the lowest cost players in the Rare Earth industry. Peak is developing the Ngualla Project into a next generation Neodymium and Praseodymium (NdPr) Rare Earth project with its process 100% tailored to focus on these crucial elements. NdPr are the key enabling raw materials, the heart, of the electric mobility revolution.

- Asian Metal: Thanks a lot for accepting the interview of Asian Metal, Michael. Would you please to introduce your company firstly?

- Michael: Peak Resources is an Australian listed company (PEK) aiming to become one of the lowest cost players in the Rare Earth industry. Peak is developing the Ngualla Project into a next generation Neodymium and Praseodymium (NdPr) Rare Earth project with its process 100% tailored to focus on these crucial elements. NdPr are the key enabling raw materials, the heart, of the electric mobility revolution.

Peak Resources’ Rare Earth deposit in Tanzania Ngualla

Peak Resources’ Rare Earth deposit in Tanzania Ngualla

Peak Resources’ Rare Earth deposit in Tanzania Ngualla

Tanzania Ngualla deposit

- Asian Metal: Would you like to introduce Ngualla project? What do you think is the advantage of Ngualla Project?

- Michael:Ngualla located in Tanzania is one of the world’s largest and highest grade undeveloped NdPr rare earth deposits. Its superior mineralogy combined with the unique advantages of the Tees Valley refinery location in the United Kingdom makes Peak the lowest operating and capital cost project of any comparable rare earth developer. We believe it‘s all about the quality of your project, your team and project economics / financability – all areas that Peak and Ngualla excel in.

- Peak has an estimated breakeven cash cost (before royalties, interest, tax, depreciation and amortization) threshold of just US$32.24 per kg of NdPr produced. This threshold is purely derived from our NdPr production (total annual project OpEx of US$91miliion divided by our annual NdPr output of 2,810 tpa) and does not take into account the 10,000 tpa of Lanthanum and Cerium carbonates or the 625 tonnes of SEG and Mixed Heavy Carbonates that will be produced as “by-products”. To my knowledge, this is the lowest breakeven price of any rare earth development project and would also place us in the lower cost quartile of current producers worldwide. These numbers really demonstrate the quality of the project and we are planning to publish in Q1 2018 a detailed Benchmark report which underpins this.

Tanzania Ngualla Camp accommodation

Tanzania Ngualla core trays

- Asian Metal: As far as I learnt, In July 2017 Tanzanian Government changed the legal framework governing the natural resources sector. The application for a Special Mining License (SML) was lodged with the Ministry of Energy and Minerals on 30 August 2017. Is Peak Resources is applying for the SML?

- Michael: Tanzania has a long history of being a stable, low risk and safe investment jurisdiction. The legislative amendments in 2017 were made by the government in response to practices by foreign companies in the gold sector and their impact is limited on our project. Since the changes, the government has worked pro-actively to prove that Tanzanian is still an attractive investment destination and open for business. Peak has always enjoyed a high level of support from all levels of government and the general public and we have been given assurance that consideration of Ngualla’s SML application will be given priority by the newly created mining commission. We expect the granting of our SML application will be a formality following the granting of the Environmental Impact Assessment Certificate in March last year.

- Asian Metal: What's the major issues you are facing? How about the solutions?

- Michael: While we are focused on the granting of the SML as mentioned above our core focus in 2018 will be to find industry support for our project including the securing of off-take agreements. Peak is perfectly placed to offer high quality products from an ethical, fully transparent supply chain solution and must focus its efforts on engaging with potential offtakes and strategic partners in order to secure funding and financing for the project.

Rare earth refinery location Uk Wilton International Site (“Wilton”) in Tees Valley

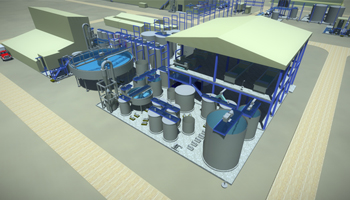

Peak Resources UK Refinery - Leaching facility

Australia Perth Blending of 66t of Pilot-Plant-Feed

Peak Resources - The Managment Team - Michael Prassas, Rocky Smith, Graeme Scott and Lucas Stanfield

- Asian Metal: What’s your next programme for Ngualla? What’s your project’s development prospect in the coming years? What do you see as the main challenges for this?

- Michael: From a technical perspective, the project is de-risked and we do not require any further programs on that side. We were one of the first projects to successfully test and pilot the entire process plant from mine to oxide production and complete a successful feasibility study. We are now ready to commence detailed design and construction. Financing and Off-takes is the main focus and as soon as we have this in place we aim to be in production 2-3 years later. We are one of the few Rare Earth project worldwide which aim to be fully vertically integrated. We plan to build an in-house Rare Earth operation that is capable of completing the entire process, from the mining pit right through to the full separated oxides. Our objective is to become the next Lynas. We also have plans in place to convert the oxide to metal, but we will get the oxide operation up and running first.

- Asian Metal: After 6 years' declining, PrNd oxide and neodymium oxide prices increased gradually in this H1 and climbed up sharply in July and August. As downstream consumers reduced purchasing and held wait-and-see attitudes, the markets began to witness limited buying activities and dropping prices since this September. Although the prices picked up a bit last week, most of participants still lack confidence in the markets as buyers are inactive to replenish stocks. Would you like to share your opinion about rare earth price trend in the coming year?

- Michael: The past 8 months were an interesting period for NdPr. I think we got a taste of how the Chinese Government’s commitment to crack down on regulations will affect the market dynamics going forward.

- With their governmental program “China 2025”, China has set a clear path to launching an industrial transition and move away from the old ‘dig and ship’ mentality.

- During 2017 China poured billions of USD into NdPr relevant applications and their related infrastructure such as high speed magnet trains, Industrial Parks, Wind Farms and Electric Vehicle development. This electrification of our society will be the main catalyst for NdPr price increases- especially in E-mobility. Many people don’t realise that nine out of ten mobility applications that use a lithium-cobalt-graphite battery are also using an NdPr permanent magnet motor. With each of those motors representing a minimum incremental demand of 1kg NdPr oxide, the math speaks for itself! I believe this fact is the biggest blind spot in today’s global commodity market! To meet the predicted demand increase several Nguallas would need to come into production by 2022.

- Asian Metal: Rare earths were widely used in NdFeB magnet, catalyst, polish powder, hydrogen storage alloy powder and phosphor powder industries. What's your opinion about rare earth demand in the coming years?

- Michael: I expect that by 2020 we will see a very different rare earth pricing landscape than today. I believe that Neodymium, Praseodymium and to a certain extent, Dysprosium will be in high demand over the next decade with the major change from previous upturns being that the price hike will be underpinned by genuine industrial demand as opposed to political issues therefore creating a long-term transformation. It will be interesting to see how the market, and particularly offtakers, will handle this situation.

- I believe that the demand for NdFeB magnets, and respectively NdPr will also continue to rise significantly. As the majority of car manufacturers aim to achieve up to 20-30% of their annual revenues through electrified solutions, diversification of the currently Chinese dominated supply chain will be crucial for businesses to succeed. China will not have enough NdPr to serve the future export market and for this reason, I believe rare earths will become a primary focus for serious investors in coming years.

- Asian Metal: Thanks for your time and support for Asian Metal. Wish you every success in your business

- Michael: Thank you for having me. If any of your readers would like further information on Peak or the Ngualla Project, the Peak team and I can be contacted through our website www.peakresources.com.au or on +61 8 9200 5360 and we are also looking forward to attending the Asian Metal’s 10th International Rare Earth conference in May 2018.