Optimizing product portfolio to thrive in the steel export adversity

----Interview with He Yingliang

Deputy Director

CUMIC

- CUMIC is a professional, independent steel trading company active around the world, dealing with products such as flat steel, long steel, steel pipe and special steel. We work hard to respond quickly and flexibly to our customer’s needs. For more than 10 years, we’ve been passionate about achieving better purchasing results for our customers.

- Asian Metal: Good afternoon, Mr. He. Thanks a lot for agreeing to the interview. Please could you briefly tell us about the scale and major products of your company.

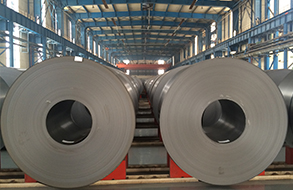

- He: It's my pleasure. Founded in 2006 in Hongkong, with the yearly trading volume of approximately 1.2 million tons, CUMIC mainly deals with hot rolled coil, cold rolled coil, steel plate, galvanized steel, coated, wire rod, rebar, steel pipe and section steel, etc.

- Asian Metal: Which domestic mills do you mainly cooperate with? Where are your materials exported? How about customers?

- He: We have built harmonious and steady relationship with major domestic producers such as Baosteel, Bengang Steel, Ansteel, Baotou Steel, HBIS and so on.

- At the beginning of the creation in 2006, we endeavored to develop North American and Middle East markets, and we matched into markets of Central America, South America and South Africa in 2007. We began to develop markets of Europe and Southeast Asia in 2010.

- Generally speaking, America and Asia account for one third of our export products each, and Europe and Africa account for the rest one third. Besides, most of our products are sold to end users directly, whose demand is relatively steady.

- Asian Metal: Though facing heavy environmental protection pressures, currently most domestic HRC mills are producing regularly boosted by considerable profits, and the output did not see obvious reduction. However, the export volume shrank significantly as mills prefer to sell within Chinese domestic market rather than export for the higher profit of the former. Statistics from China Customs showed that China exported roughly 5.886 million tons of steel in July, down by 15.2% on a month-on-month basis and 15.4% on a year-on-year basis. How do you think the situation in Q4?

- He: The total output from domestic producers remains high, but that for export has been reduced day by day. Actually, most mills forecasted increased export volumes in Q3 and Q4 at the beginning of the year, but the volume in Q3 was reduced sharply as prices in the domestic market increased unreasonably boosted by kinds of news about the production reduction during the heating season period in North China. It's inevitable that mills will increase the domestic sales and cut that for export when the price in the domestic market rises.

- Personally, I do not think the situation in Q4 will change much on the basis of March. On the one hand, the supply for HRC will be reduced to some extent influenced by the heating season environmental protection policies, while on the other hand, unlike construction steel whose demand is much influenced by weather, the demand for flat steel is relatively steady. Therefore, prices for HRC and other flat steel products will surely go up when the supply is cut but the demand is steady, which means materials for export will be reduced further.

- Asian Metal: Prices for HRC increased by approximately RMB100/t (USD15/t) since early July in the domestic market of China, but those for export witnessed a markdown of roughly USD20/t influenced by the depreciation of RMB during the period. How do you think about the HRC export price trend in Q4?

- He: As I mentioned before, the price for HRC in the domestic market of China will certainly go up in the fourth quarter when the supply is cut and the demand is stable. Mills will be reluctant to decrease export prices in view of the upward price trend in the domestic market. As a consequence, I think that the export price for HRC is likely to increase slightly and slowly in Q4.

- Asian Metal: Since the start of the "301" act on April 5th, the trading war between the US and China initiated. The United States firstly imposed 25% tariff on roughly USD50 billion of products from China in July and August, and then announced on September 17 to levy 10% tariff on imports of about USD200 billion products from China from September 24 to the end of this year. What is the impact of this action on China's steel exports?

- He: Actually, the direct effect of this action is faint. China exported approximately 1.18 million tons of steel to United States every year, only accounting 1.1% of our total export volume.

- However, the indirect effect is profound. It will weaken confidence of the futures and capital markets. It's well know that besides the supply and the demand, capital market also plays a key role in the steel price.

- Meanwhile, the influence of United States restraining imports from its allies is the most devastating. Taking South Korea as an example, in 2017, China exported 11.4 million tons of steel to South Korea, staying among the largest export destination in our exports. If United States reduces the imports from South Korea, its orders for China's products will shrink accordingly.

- Asian Metal: How about the competition from other HRC producing countries such as Turkey, Russia and India?

- He: Yes, materials with lower prices from those countries restrained our exports to Asian and European markets to a large extent. Steel export prices from China have been hiking in recent two years, and the low price advantage faded away gradually. For example, the export price of HRC soared to USD580/t FOB China this year from USD280/t of early 2016, and overseas buyers complained unreasonably high price and were cautious about placing large orders.

- Asian Metal: Facing serious trade friction against neighboring countries, more and more Chinese exporters have tended to develop emerging markets such as South America and South Africa in recent one or two years. Do you have similar strategy? How about the progress?

- He: In fact, as early as the founding in 2006, we have already focused on the development of the America and the Middle East markets, and later for the Central and South American and South African markets. We have gained regular and reliable clients in those markets.

- In the future, our general policy is to continue to develop high-quality customers, increase the proportion of high value-added varieties and reduce the proportion of extensive low-end products.