Metro Mining is confident about Chinese demand for imported bauxite in the short term and long run

----Interview with Mr. Norman Ting

General Manager

Metro Mining Asian Marketing Department

- Metro Mining Limited (ASX: MMI) is an Australian exploration & mining company based in Brisbane, Queensland.

Mining operations at Metro’s flagship project, the Bauxite Hills Mine, commenced in April 2018.

Located 95 kms north of Weipa on western Cape York, the Bauxite Hills Mine is one of the largest independent projects within the internationally acclaimed Weipa Bauxite Region.

Metro Mining holds a total bauxite tenement package covering approximately 2,500 sqms on Western Cape York.

- Asian Metal:Based on China Customs, China imported around 25.5 million tonnes of bauxite from Australia in 2017, up by around 20% YOY. Do you think the rising trend will continue in the coming few years?

- Norman:Yes, I think so. For example, Metro Mining started bauxite production from this April and aims at around 2 million tonnes in 2018.

- Asian Metal:Compared with other bauxite, how do you think of the advantages of Australian bauxite?

- Norman:Every kind of bauxite has both advantages and disadvantages, which is dependent on the specifications, chemicals and mineral structures. Because of tight bauxite supply in China, Chinese alumina refineries used to mix kinds of bauxite for alumina production, including bauxite from Australia, Guinea, Ghana and Indonesia, etc. Metro Mining's bauxite in Cape York is characterized with high alumina and high silica, which is more available for high-temperature production line, as well as for mixed bauxite. The ratio for bauxite mix is different for alumina refineries. I think Chinese alumina technicians are more creative and practical in the world.

- In addition, the freight cost from Australia is a very competitive advantage. It only takes around 10 days from Australia to China, while it needs 45-60 days for some West African countries and Brazil. Also, the political situation in Africa is not stable, affecting bauxite production. The export policies in Indonesia and Malaysia are flexible. Australia does not have the factors.

- Asian Metal:How about the progress for Metro Mining bauxite?

- Norman:We launched the project on April 9 and will have the first shipment on April 19. The first two shipments will be sold to Xinfa Group of China and we will have extra sales in the market from May or June and are developing new buyers. We plan for 2 million tonnes in 2018, 3 million tonnes in 2019 and 4 million tonnes in 2020, and the total annual capacity will reach 6 million tonnes in the coming four years.

- Asian Metal:Indonesia and Malaysia resumed bauxite export, which may affect other bauxite. How do you think?

- Norman:We have realized the fierce competition. Every bauxite owner has their own clients and end users. Global alumina prices jumped recently due to the U.S. sanction on Rusal, and a number of alumina refineries resumed production after winter environmental protection policy. Besides of refineries in Shandong, a few in Shanxi and Henan also negotiate with us. In addition, a few new big alumina projects in Liaoning are planned for building. I attended the opening ceremony of Bosai Group's Yingkou alumina refinery with annual capacity of 2.5 million tonnes early the month. It is reported that there are several other projects in Jinzhou,, Dandong and Caofeidian, which will all demand imported bauxite. In the long run, the demand for imported bauxite will continue rising.

- Asian Metal:Is your bauxite monohydrate? How about the specification?

- Norman:To be serious, our bauxite is tri-hydrate, including part soft monohydrate bauxite, different from Chinese hard monohydrate bauxite, e.g. dissolving temperature, lime consumption. According to technological test, the bauxite is more available for high-temperature line. Total Al2O3 50-54%, Total Silica 10-12%.

- Asian Metal:How about the location, port building and transportation?

- Norman:The mine is located in West Cape York of Queensland, East Australia, around 93km to Weipa of Rio Tinto. The port is close to China, only around 10 days to Chinese major ports. Nearby the mine, there is a river, around 20 sea miles. We use barges for river transportation and the vessels waiting in the sea have loading capacity of 60,000t.

- Asian Metal:As we just mentioned, bauxite supply in Henan and Shanxi of China is tight. Do you think there is any technical problem for Australian bauxite in the new regions? How to cope with the problems?

- Norman:By my knowledge, a few vessels of Australian bauxite have been exported to those new regions. It usually takes time for refineries to suit a new kind of bauxite. However, Australian bauxite has been widely mixed with Guinean bauxite in alumina refineries in Germany for many years.

- Just as I mentioned, every kind of bauxite has both advantages and disadvantages, so newly built alumina refineries have both low temperature and high temperature lines for flexible bauxite resources. Instead, one kind of production line will be very limited in bauxite resources and production. Strategically, to have flexible bauxite resources will be more sustainable for alumina production.

- Asian Metal: Besides of Xinfa Group, how about Metro Mining's sales strategy?

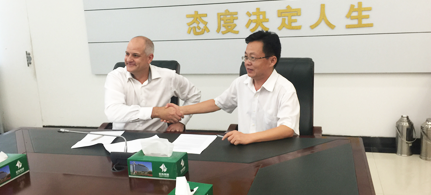

- Norman: We have signed off-take agreement with Xinfa Group in 2016. Metro Mining is very appreciative. According to the agreement, 50% of our production in the first four years will be sold to Xinfa Group, around 7 million tonnes. In 2018, we will have around 1 million tonnes for extra sales.

- Asian Metal:Do you need to add more information in terms of Metro Mining or Australian bauxite?

- Norman:Metro Mining is specialized in bauxite mining instead of alumina and other products. We do not compete with our buyers. Our shareholders are encouraging us to develop new bauxite mines in other regions of Australia and other countries. The experience over the past three years witnesses that, under the lead of our CEO Mr. Simon Finnis, our team will do better.